Crypto Investing Fast Start

STEP 1: download The Jifu App And Subscribe to All Jifu Crypto Educators 📲

(Click the buttons to download apps below)

Subscribe to: Nick Gomez, Corinne Florence, Curtis Kobane & Daniel Lopez,

step 2: Learn the basics of crypto

Plug into the beginner and intermediate module on Jifu Live (login and click on crypto academy)

Step 3: Set up a Beginner crypto Portfolio

Set up a Simple to use exchange

Coinbase (United States & Everywhere Else)

Kraken (Canadian Explanation)

2. Add some money in and start investing (follow this guide below)

NOTE: Do Your own Research on all projects these are just guides NOT financial advice.

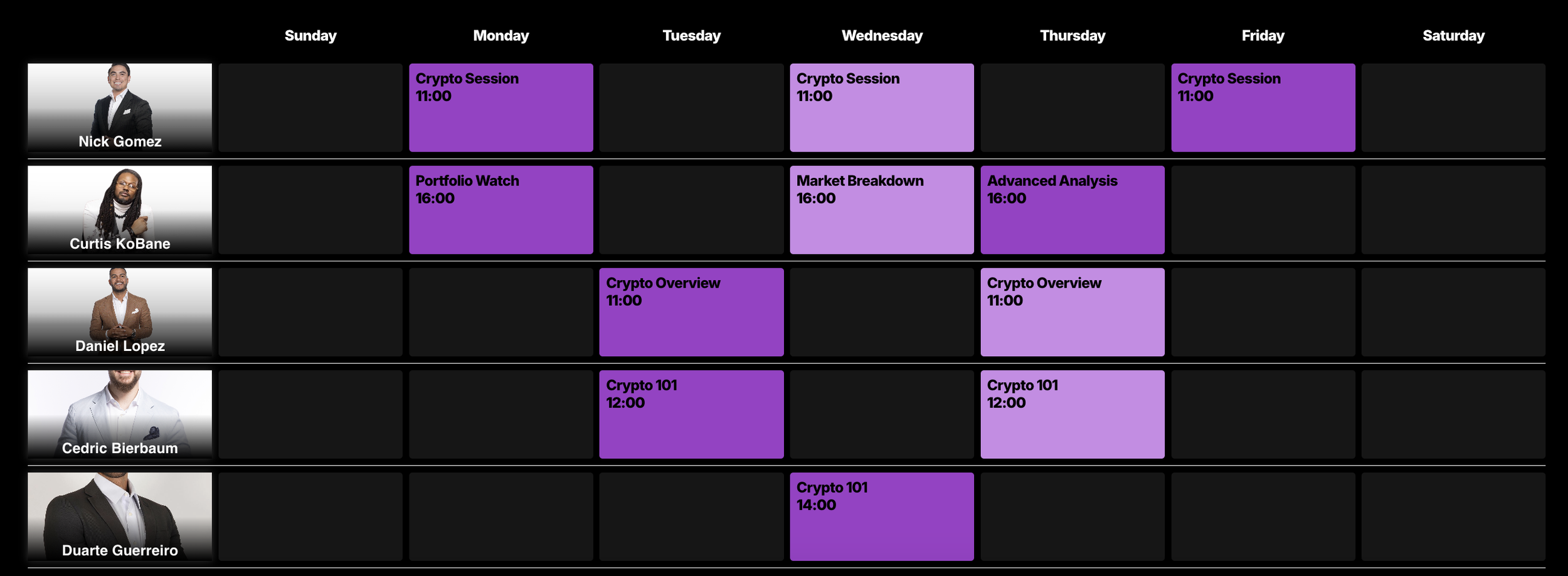

Step 4: Start Plugging into the live lectures & Taking the live Call outs

Start plugging into the live sessions on Jifu Live to stay up to date and properly invest into crypto longterm

(see step 2 on how to access Crypto Educators on Jifu Live)

Creating an exit strategy for your crypto:

1. your forever holds (a percentage of your portfolio you will hold for years; 2030) anywhere from 20-50% of what you own for each cryptocurrency,

2. Take profit levels where you are securing 10-25% at certain prices during the bull market; should have multiple set at levels like All time highs & key price levels ie. $100k BTC, $3 XRP etc.

How to use different platforms:

Metamask (ETH/BASE based)

Phantom Wallet (SOL Based)

Leger (Safe place to store your LT coins)

RFG GUIDE 2 (BASED ON RISK)

Portfolio Build in Order of Safest to Riskiest; more money you can go more riskier.

Portfolio 7 is just all in on risk.

Portfolio 1 : BTC & ETH equally

Portfolio 2 : BTC 25%, ETH 25%, SOL 20%, XRP 20%, other 10% Gala ICP and/or ADA.

Portfolio 3 : BTC 20%, ETH 20%, SOL 15%, XRP 15%, rest split amongst: Gala, ICP, ADA, LINK, DOT, SEI AVAX , KAS ONDO STX Hedera

Portfolio 4: 60% split amongst (BTC, ETH, SOL, XRP), 40% split between coins like: Gala, ICP, ADA, LINK, DOT, SEI STX AVAX, KAS hedera. These are your musts.. then from there add coins like: FTM, SAND, ALGO, FIL, Algo, JUP, Matic, MIOTA, DOT, VET, ONDO

Potfolio 5: 50% split amongst (BTC, ETH, SOL, XRP), 10-20% in stable coins like USDT and USDC, 80% of what is remaining in coins like: Gala, ICP, ADA, LINK, DOT, AVAX, KAS STX Hedera These are your musts.. Then from there coins like these fall into same criteria: SEI, FTM, FIDA, SAND, PERP, ALGO, FIL, ALGO, JUP, Matic, ATOM MIOTA, DOT, VET, XLM, XTZ, MANA QNT, IMX, FETCHAI , Render and then the final 20% into high risk high reward: NFTs + coins like:, BONK, PEPE, ONDO Rif etc.

Potfolio 6: 50% split amongst (BTC, ETH, SOL, XRP), 10-20% in stable coins like USDT and USDC, 80% of what is remaining in coins like: Gala, ICP, ADA, LINK, DOT, AVAX, KAS STX Hedera. These are your musts.. Then from there coins like these fall into same criteria: SEI, FTM, FIDA, XDC, SAND, PERP, ALGO, FIL, ALGO, JUP, Matic, MIOTA, DOT, VET, XLM, XTZ ATOM, Render MANA QNT, IMX, FETCHAI, and then the final 20% into high risk high reward: NFTs + coins like:, Rif ONDO etc.

Portfolio 7: Forget the Main coins and the stable coins put all your money into the rest of the coins; Gala, ICP, ADA, STX LINK, DOT, AVAX, KAS, SEI, FTM, FIDA, XDC, SAND, PERP, ALGO, FIL, ALGO,ATOM, JUP Hedera, Matic, MIOTA, Render DOT, VET, XLM, XTZ, MANA QNT, IMX, FETCHAI, BONK, PEPE,, Rif ONDO etc.

You want to cycle 25-30% of your trading profits into these portfolios so you can get up to at least 5 figures into crypto.