Asset Accumulation

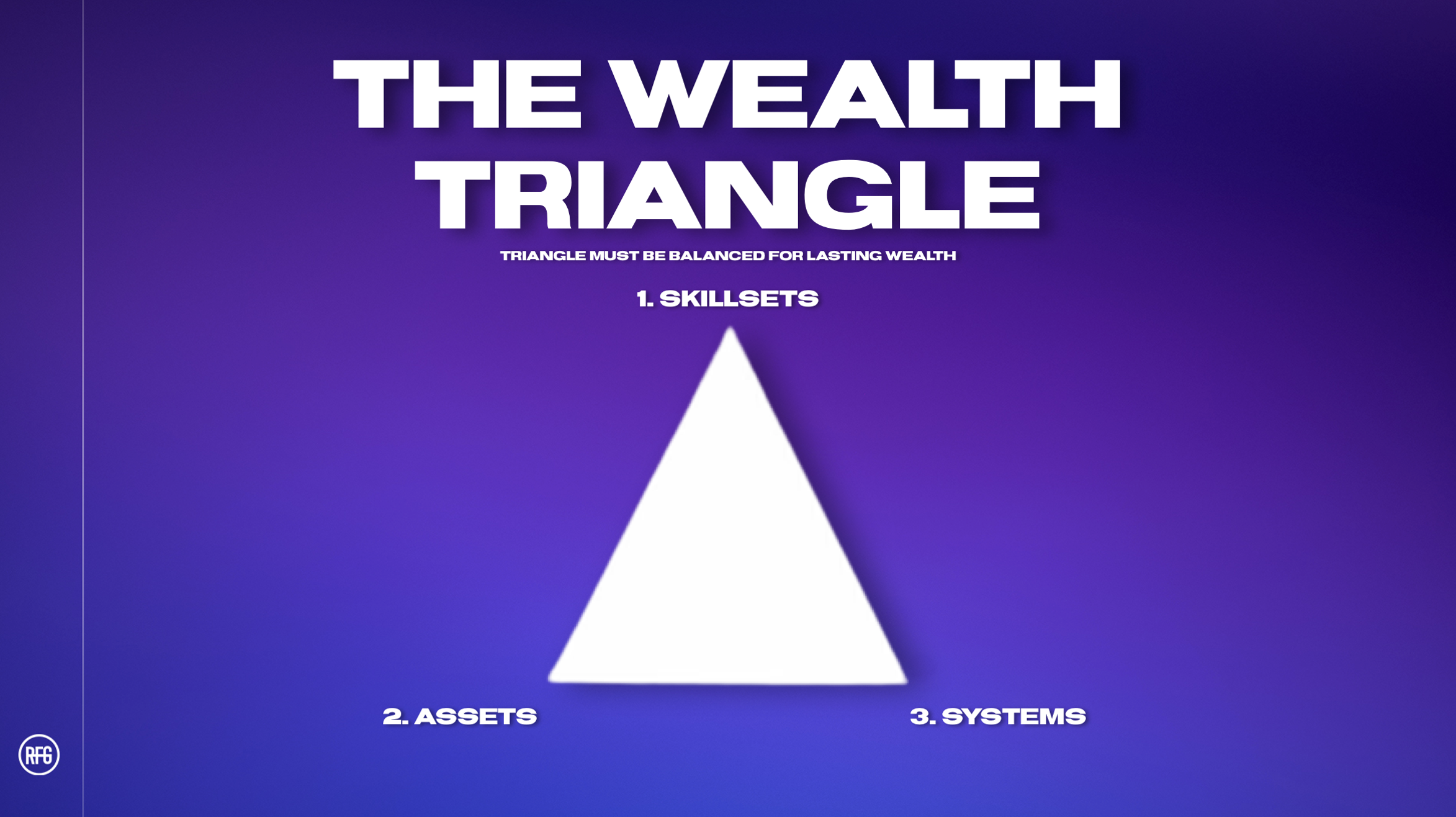

STEP 1: Understand The wealth Triangle

At this point you should be having consistent active income coming in from Trading, Digital Marketing and/or Network Marketing (skillsets), enough to have capital available to invest.

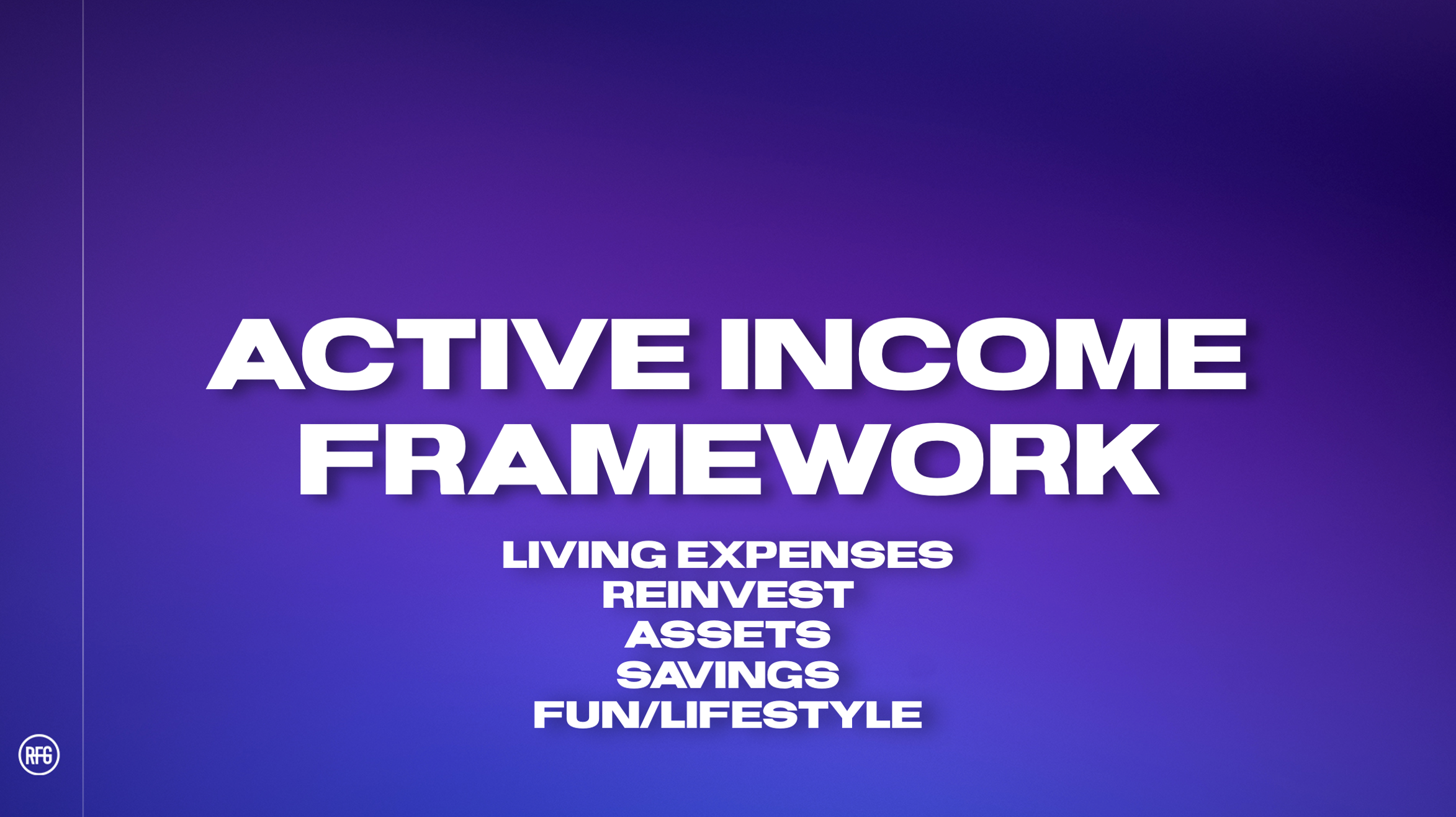

step 2: Understand the split

Once you start earning active income from your skillset, your first priority is to secure the essentials: covering any basic living expenses that your current job doesn’t already meet. From there, focus on scaling your active income by reinvesting in yourself: attend industry events, pursue further education, and invest in the tools and technology that will help you grow. Keep lifestyle spending and personal savings lean: around 5–10% of what you earn, so you can allocate the majority of your capital toward future asset-building opportunities. This approach ensures your hard-earned income fuels both your immediate stability and long-term wealth creation.

Step 3: Look out for opportunities

Keep an eye on the Assets chat for real estate and business opportunities, by now you should already have a crypto portfolio. Whenever you’re approached with any new investment deal, bring it to the RFG Leadership team first. In the early stages of building capital it’s easy to fall into bad investments, and a quick review from experienced leaders can help you avoid common traps while making smarter, long-term wealth moves.